Learn how student clubs and organizations can fundraise through official University channels.

Creighton University is a tax-exempt public charity as described in section 501(c)(3) of the U.S. Internal Revenue Code. All gifts qualify as charitable donations and are eligible for income tax deductions as allowed by law. Donors should consult with their professional advisors when determining the deductibility of their charitable contributions. To keep things simple and compliant, just be sure to follow University guidelines and reach out to CreightonFund@creighton.edu with any questions!

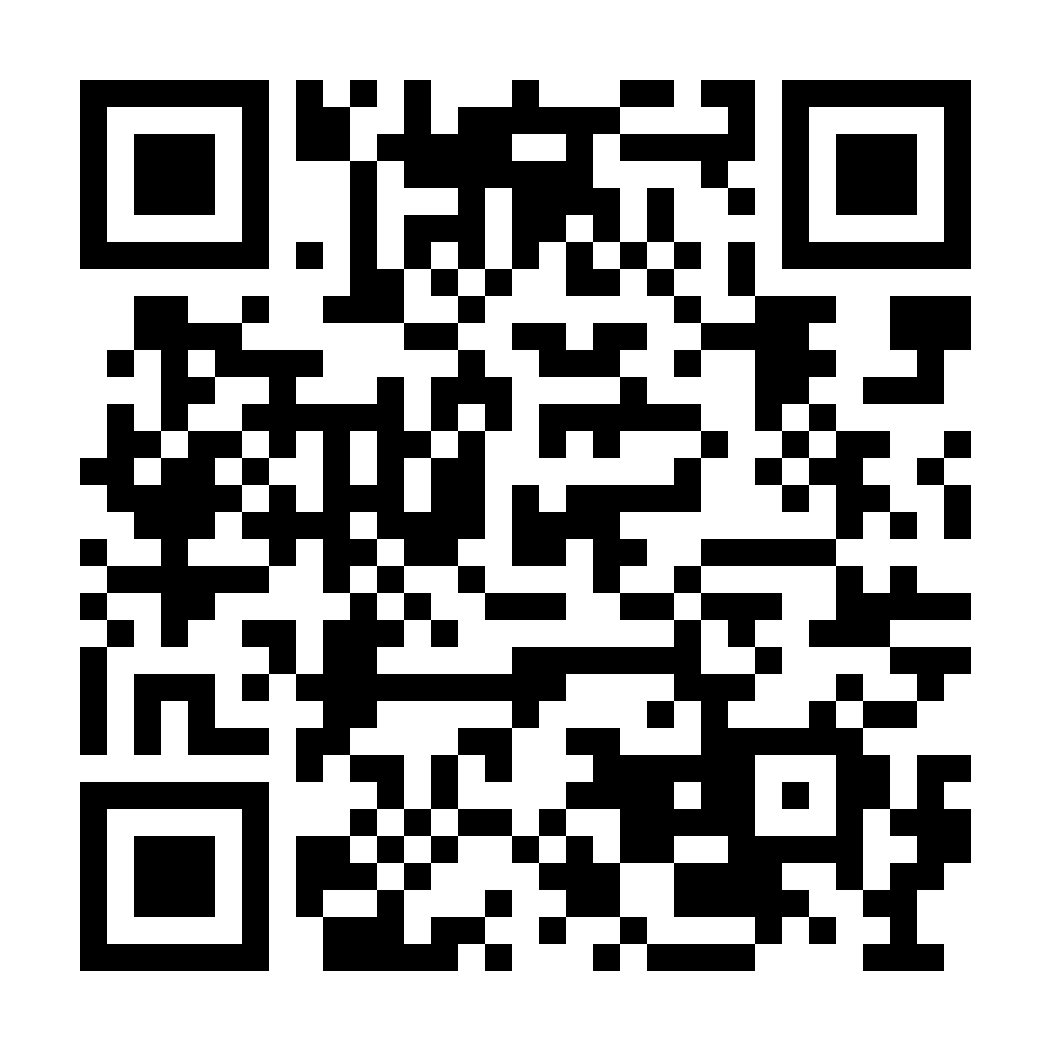

Student groups may use this form to fundraise for their club:

Creighton University Student Registered Clubs/Organizations Fundraising Information

Are student groups at Creighton considered a part of the Creighton University corporation?

- Yes. Registered student clubs/organizations are legally part of the University through the Creighton University Student Groups LLC.

- For an official list of registered student clubs at Creighton, contact the Student Leadership & Involvement Center – slic@creighton.edu

Can donors contribute directly to a student group and receive charitable tax receipts?

- Yes. University Relations (UR) facilitates all fundraising efforts for the University. Donors must donate using the specific UR online fundraising form for registered clubs/organizations and selecting the student group of their choice.

- Donors may also mail a check, made payable to Creighton University, to:

Creighton University, Student Leadership & Involvement Center

2500 California Plaza, SSC 205

Omaha, NE 68178

In the memo line add the name of the club that the check is supporting.

How do student groups access money donated to their areas?

- Funding will be transferred into the registered club/organization’s fund/org account on file with UR following the completion of the fundraiser. It may take up to 3 weeks for students to receive funding in their accounts after a gift has been made.

Can student groups fundraise for their areas?

- Yes. They must direct donors to the University’s online student group fundraising page where donors can make donations directly to the areas of their choice. Donors will be issued charitable tax receipts as appropriate.

- Food nights/percentage fundraisers: Business sends check payable to:

Creighton University to the Student Leadership & Involvement Center

2500 California Plaza, SSC 205

Omaha, NE 68178

In the memo line add the name of the club that the check is supporting. - Student groups cannot use outside, third-party software platforms for their own fundraising (example: GoFundMe, Venmo). Students should work with University Relations to ensure they are compliant with University fundraising policies and procedures.

Can student groups fundraise for other non-profit organizations?

- Yes. They must work directly with the external non-profit to coordinate their efforts. The University cannot receive or facilitate donations on behalf of third-party non-profit organizations, including fundraising conducted by student groups. All fundraising must be conducted directly through the external non-profit.

Don't see your student club/organization or campus on the form?

-

Please use the "other" option on the form and enter your club's name and campus' name.

Are efforts such as bake sales, ticket sales for an event or car washes considered fundraising?

- No. Student groups may sell items or provide services for fees, but these efforts are not considered philanthropic. They should follow student organization fundraising and event guidelines in the Student Handbook.

Who should I contact if I have questions?